It’s difficult enough to stay on top of your own finances – to constantly pay bills, mortgages, car payments, insurance payments, groceries, health care, and other personal expenses all while trying to save and invest along the way. Sometimes you can adopt a tunnel-vision mentality, plowing through the list of tasks and duties while taking care of your whānau. Therefore, and rightly so, managing finances ranks in the top 3 interests for Māori families.

A few statistics: According to Te Puni Kōkiri’s In-Print on

Māori Families and Households (

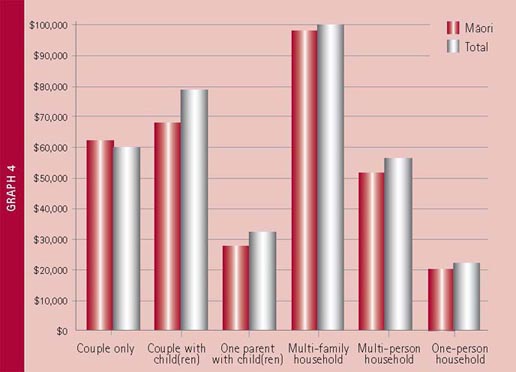

http://www.tpk.govt.nz/en/in-print/our-publications/fact-sheets/maori-families-and-households/page/7/), Māori living in different household types experience significant differences in median household income. Households in which multiple people are likely to be earning income have the highest household incomes, including $98,100 for multi-family households, $68,300 for couple with child(ren) households, and $62,400 for couple only households. In comparison, Māori living in households primarily or exclusively reliant on single incomes have the lowest household incomes, with $20,500 for one person households, and $28,000 for one parent with child(ren) households. Māori households tended to have slightly lower median household incomes than the total population (although not for couple only households), but the differences in income between household types were far greater.

Here are a few online suggestions as to how you can manage your personal and business finances including Māori Trusts and Organisations. This is also a great time to teach our children how to effectively manage money and the concepts of saving, waiting to buy the things they want and more!

Managing Finances for Children

Your children are taking in your actions and learning from example. How you manage your finances can affect how they manage theirs later in life. It may even be a good idea to let your kids play around with the calculators to determine some of their own ways to save money. It’s never too soon to teach them the value of saving. It is important to teach your older children the value of using the web and other tools at their disposal to find the best price for the items they purchase, in tandem with teaching them the fine art of negotiation. As any astute businessman or executive can tell you, strong negotiation skills can go well beyond saving a few dollars over a lifetime. Your children, even the youngest ones, may surprise you with just how well they understand the concept and the value of keeping good financial habits. It is in their best interest to start early and continually encourage them to grow their own pot as they mature.

There are a number of fantastic resources available to guide you and your children every step of the way, including sites like MoneyAsYouGrow.org, that offer suggestions on how to approach financial decisions through every stage of life.

So how can you teach your kids about managing finances as they grow up?

Here are just a few examples (from WorkAwesome http://workawesome.com/management/how-to-teach-your-kids-about-managing-finances/) of things you can do for yourself that also provides a path for your children to secure their own financial independence:

Get Organized

One of the immediate things you can do for yourself is to get organized. Make sure your budget accurately reflects your income and expenses. Set up automatic payments online if you can, and if not, then create a calendar to remind yourself of payment due dates. Showing your child that you are in control and organised will give them confidence in you and in the process.

Start Investing

The moment you have an opportunity to invest, take advantage of it and do it! Try to get in the habit of stowing away some income every month. Speak with a financial advisor and try to diversify. Look for lower-risk investments. It’s okay to let your children know that it’s important to save money for the future. Even at an early age, they can put their own money away in a piggy bank and they should have their own bank account as they get older. Young children are more conservative spenders than teenagers, so it’s a good idea to get good spending habits solidified early on.

Get Insurance

Anyone with children should also have a life insurance policy. If something were to happen to you, insurance is one of the most reliable ways to ensure that your children are financially protected after you are gone. A Life Insurance policy can be utilised to cover mortgage or rent for the family home, pay for tuition and other college expenses, or even start or maintain a small business. There are some great free tools available, and many insurance companies have a calculator on their website so you can calculate your premiums as well as help to assist you in budgeting finances.

Personal Finances:

Sorted http://www.sorted.org.nz

This website helps you budget, organise finances, get out of debt and more.

Business Finances

Inland Revenue (http://www.ird.govt.nz/businesses/)

Understanding tax for your business in critical to the financial life of your business. The Inland Revenue has a mountain of great tools to help small and large business manage their tax requirements. Below are just a few direct links to online calculators and excel speadsheets.

FREE tax and seminar workshops (http://www.ird.govt.nz/contact-us/seminars/)

Also remember that your local IRD office run workshops so look online to find the next seminar or workshop available in your area.

IRD ‘Tool for Business’ (http://www.ird.govt.nz/businesses/)

The IRD Tool for Business helps you get all your small business tax issues sorted quickly and simply.

IRD Wage Summary Template (http://www.ird.govt.nz/images/flash/tfb/)

As an employer you need to complete every month an IR 348 and an IR 345. This excel spreadsheet helps you calculate the PAYE, Child Support, KiwiSaver and Student Loan deductions as well as, KiwSaver Employer contributions and ESCT Deductions.

IRD: GST requirements http://www.ird.govt.nz/gst/

Find out about Registering for GST, working out your GST, filing your GST and more!

Accounting Software

Some individuals and businesses may decide to purchase accounting software to help manage its financial records and generate profit and loss statements and balance sheets, however there are a lot of products on the market so talk to friends and have a good look around. Some organisations offer a FREE trial so look out for that! Here are a few packages available on the market today.

Reckon Professional Services Group http://www.quicken.co.nz/

The Reckon Professional Services Group provides complete accounting solutions for Accountants, Bookkeepers, and Business Professionals in order to enable them to effectively and efficiently manage their clients

XERO http://www.xero.com/

Xero online accounting software for business is a web based system for invoicing/billing, accounts payable, bank reconciliation and bookkeeping.

MYOB http://myob.co.nz/business/products-1257828257103?gclid=CN-X6cTok7QCFedKpgod3AkAqw

MYOB online accounting software lets you manage your business anywhere, anytime. Which means you’re free to work wherever and whenever you like.